Last updated: 15.08.2024

Internal invoicing

In this article

To avoid including transactions between departments of the same company in the regular sales figures and sales ledger, the internal invoicing function can be used. Sales to internal customers are then recorded in a different account from sales to external customers, and the invoices are marked as paid automatically because they are offset directly against an expenses account, without any money actually being moved.

-

Internal invoicing is not used if there are two different companies and each has its own Opter system. In this case, invoicing and crediting are handled as usual.

-

If both the departments use the same Opter system, it is not possible to use internal invoicing. Income and expenditure must be tracked in other ways, e.g. by booking the amount on an invoice to different accounts.

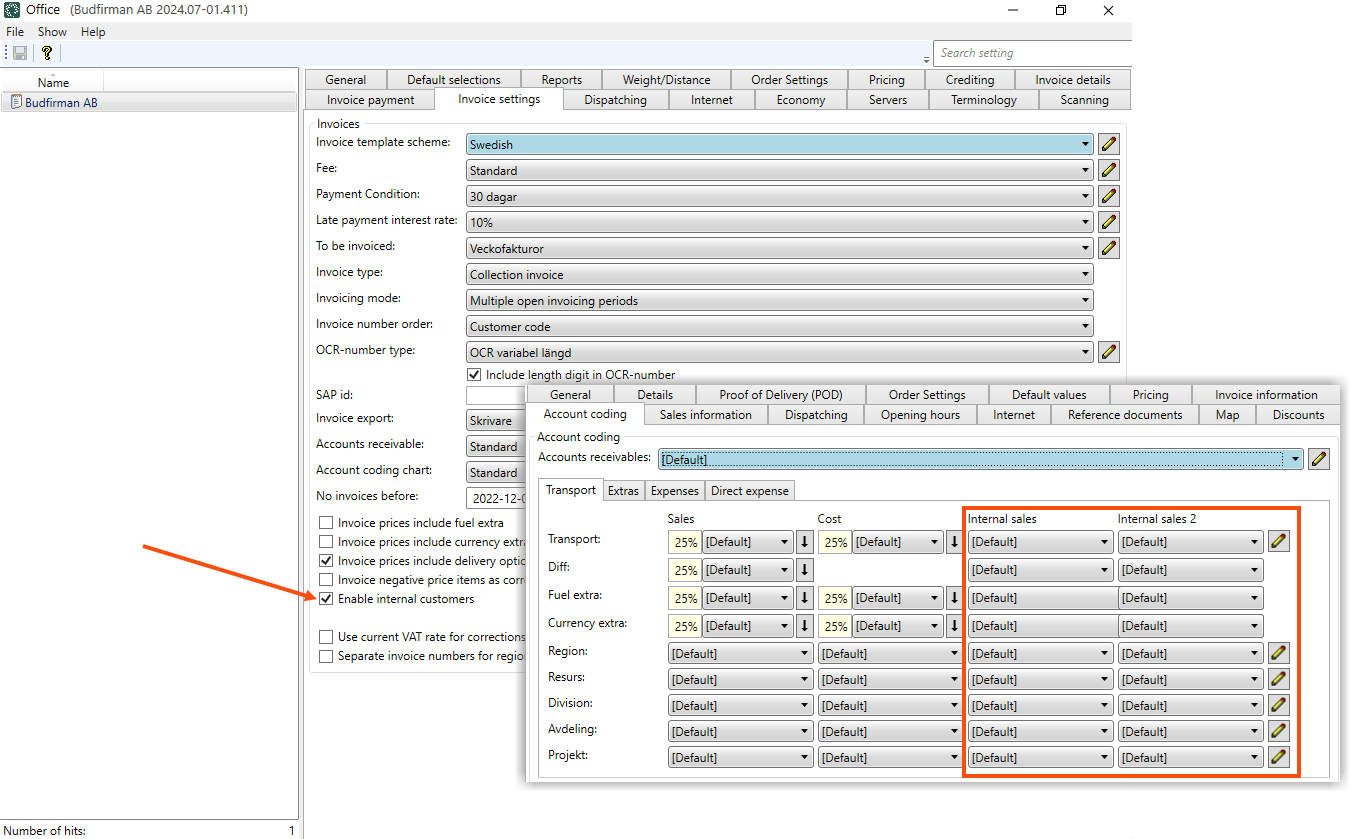

Enable the internal customer function in the office settings

Click on Settings > Offices > Invoice settings tab and select Enable internal customers. This enables the entire function and brings up the account coding settings for internal customers (see step 5 below).

If this setting is deselected, the entire internal invoicing function is deactivated and the regular account coding is used. If specific account coding settings have been made, for example in the customer registry, they will remain valid if the function is enabled again.

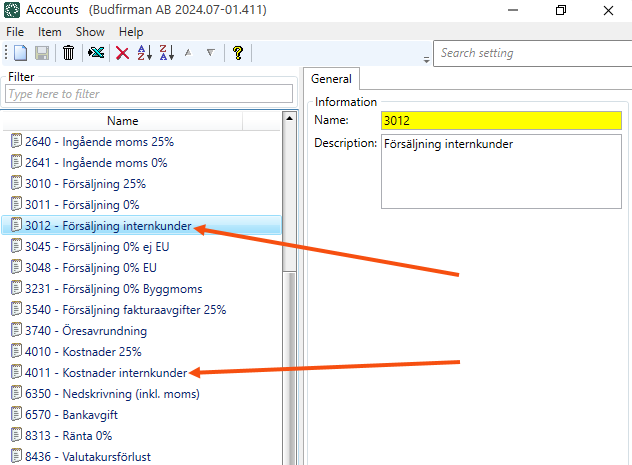

Create accounts for internal invoicing

Click on Economy > Accounts and create a sales and an expenses account with which internal invoices can be booked.

As the money only moves between different departments within the company, no VAT is charged on internal sales, so no separate accounts for outgoing and incoming VAT are needed.

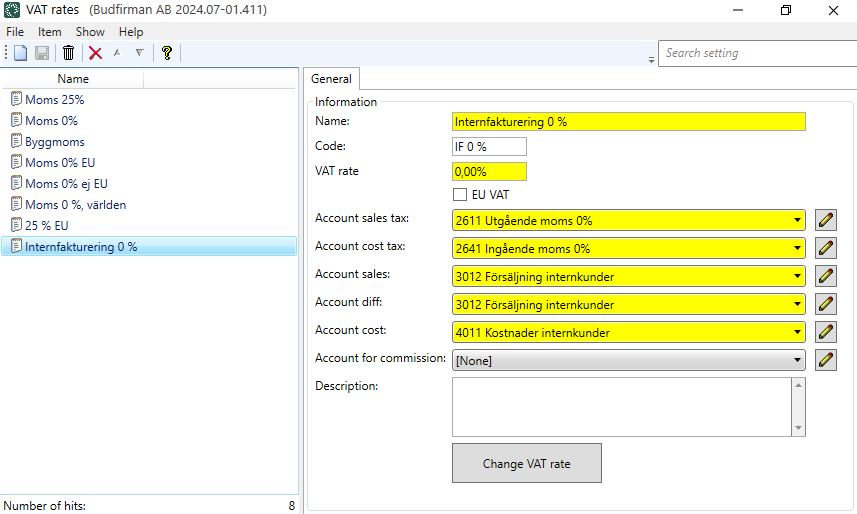

Create a 0% VAT rate for internal customers

Click on Economy > VAT &rates and create a 0% VAT rate for use with internal customers. Select the accounts for internal invoicing that were created in step 2 for sales, diff and expenses.

You can choose the usual standard outgoing and ingoing VAT accounts, but no VAT amounts are recorded in those accounts.

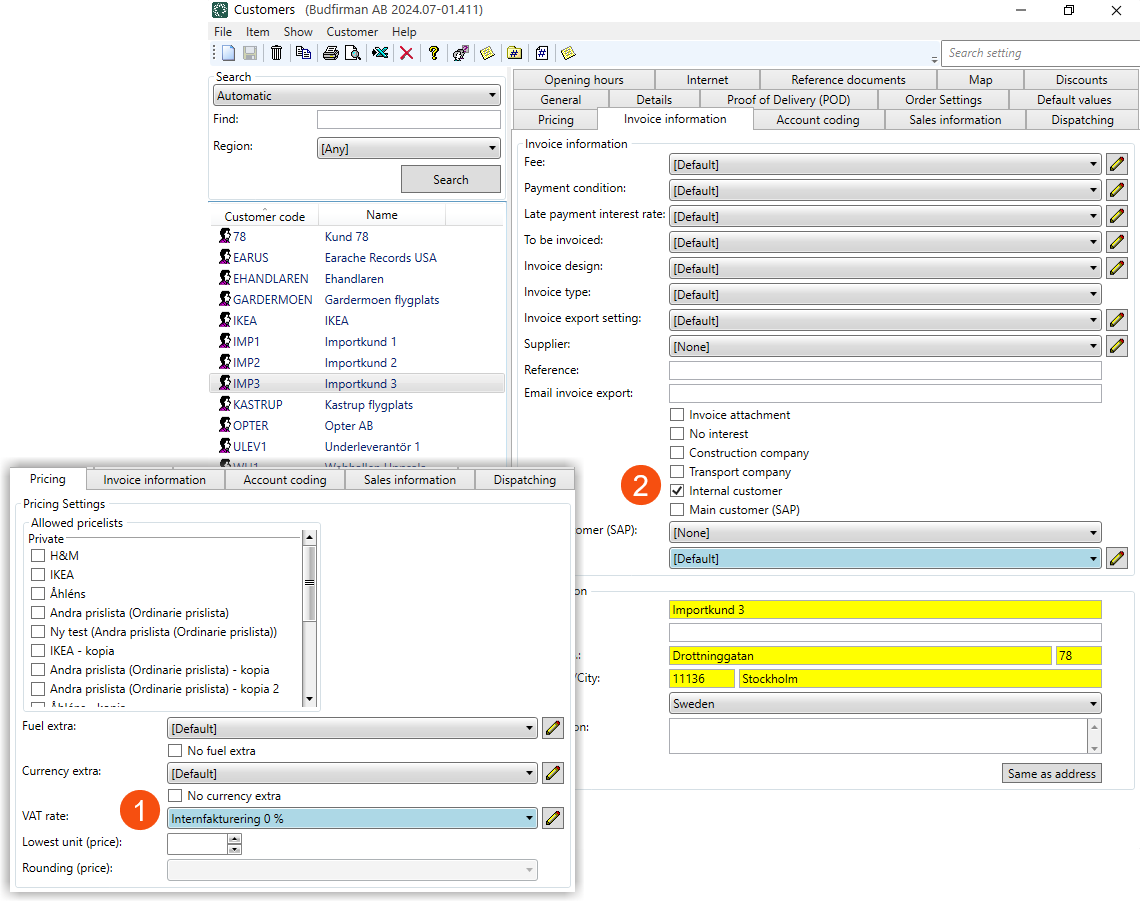

State that the customer is an internal customer and set the VAT rate

The department or company you want to internally invoice must be listed as a customer in the customer registry and be set as an internal customer.

Click on Register > Customers and search for the department/company. Go to the Pricing tab and select the VAT rate you created in step 3 (1). Then go to the Invoice information tab and select Internal customer (2). That setting does the following:

-

Account coding for internal sales is used instead of the usual account coding, see step 5 below.

-

The account coding scheme for accounts receivable is ignored, see step 5 below.

-

Invoices are automatically marked as paid (on the invoice date) when the invoice period is closed.

-

It is possible to indicate on the invoice that it is for an internal customer with the tag Header.CUS_InternalCustomer, which returns the text "True" or "False".

-

When the customer registry is exported to Excel, the customers who are internal customers are shown in the Internal customer column.

Define the account coding

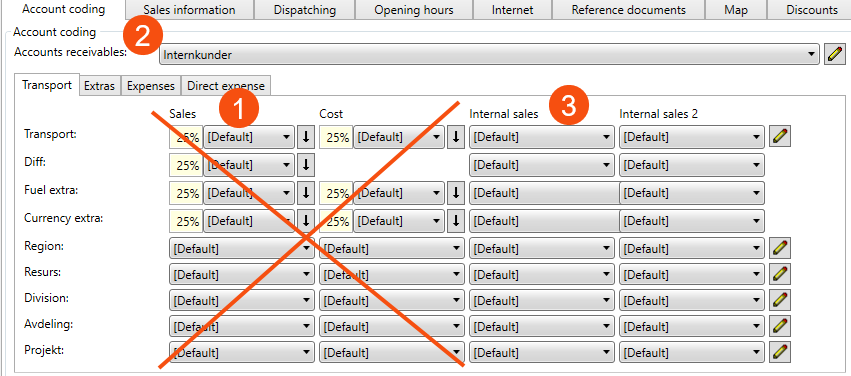

Go to the Account coding tab of the customer registry. As the function is enabled (step 1), and the customer is flagged as an internal customer (step 4), the accounts under Sales and Cost are not used (1). Similarly, the account coding scheme for accounts receivable is not relevant for internal customers (2).

Instead, the accounts under Internal sales and Internal sales 2 are used (3). [Default] means that the accounts set up for the VAT rate in step 3 are used. To use other accounts for this specific internal customer, select them from the drop-down lists.

When the internal customer is invoiced, the invoice is marked as paid and the amount is booked to the sales and expenses accounts specified for the VAT rate or in the customer registry. It is possible to create a test order and check the account coding by clicking on Preview account coding in order reception.

Example

External customer buys a complete solution and the revenue is split between different departments

Stina buys construction services for SEK 150,000 + VAT (SEK 37,500) from the construction department of Bygg och transport AB, which does not use Opter. The construction includes transport for SEK 30,000, which the construction department in turn buys from the transport department. The transport department uses Opter. Stina receives an invoice for the full amount (SEK 187,500) from Bygg och transport AB. The transport department invoices the construction department SEK 30,000. As the construction department is an internal customer, the amount is booked to the internal sales account without VAT. The amount is directly offset by a counterpart entry in the internal expenses account.

The construction department's revenue from the order is SEK 120,000, and the transport department's revenue is SEK 30,000. VAT is accounted for as usual via the building department's accounting system.

A department within a group uses Opter, but the group as a whole does not use it

The company Courier Services is part of Global Cargo. Global Cargo does not use Opter. Global Cargo has been added as an internal customer in Courier Services's Opter system. When Courier Services invoices Global Cargo, the amounts are booked directly to the accounts specified in the customer registry.