Last updated: 09.06.2020

Valid from: 2018.12.00 and later

Account coding for VAT

In Opter, the VAT is what controls the account coding. This means that accounts need to be linked to VAT rates in order to be able to choose which accounts to use in different contexts. If your company uses special account coding, it may be necessary to set up accounts for the VAT rates that are created. For more information, see Account coding in Opter.

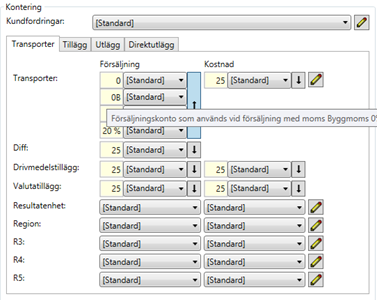

Below is an example of account coding settings in the customer registry, where it is also possible to set up a sales account for each VAT rate by clicking on ![]() to the right of the sales account drop-down list.

to the right of the sales account drop-down list.

To see the full name of the VAT rate, hover over the yellow VAT percentage figure to the left of the account.