Last updated:

Valid from: 2022.01.00 and later

Account coding in Opter

Accounts and economic units in Opter are retrieved firstly from price items, secondly from rules, thirdly from registries and finally from VAT rates. If an account is specified in an option, it is selected, otherwise Opter moves on to the next option. If no account is specified in any option, it is ultimately selected from the VAT rate (where the account must be specified when the VAT rate is entered).

The account coding is created when the invoice period or the supplier bill period is closed. In order reception, the account coding that will be applied to an order can be previewed by clicking on Preview account coding next to the price information.

Different accounts for different VAT rates

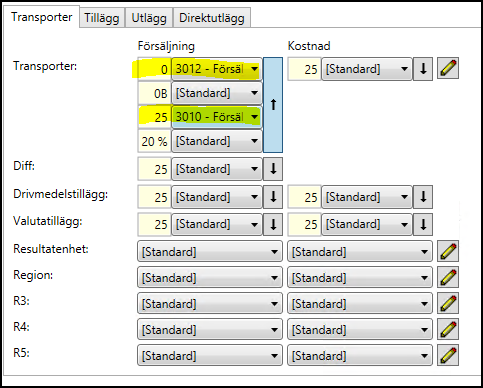

In most accounting software, a VAT rate is linked to each sales account. Opter works “the other way round” by looking up the rule that governs the account coding and then selecting the correct account depending on the order’s VAT rate.

In your accounting software, account 3012 may apply VAT at 0% and account 3010 may apply VAT at 25%.

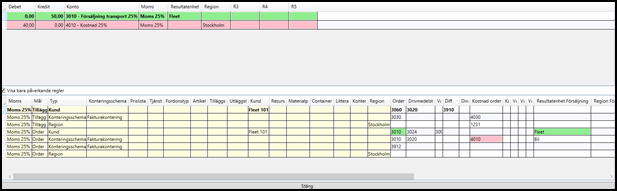

Instead, in Opter, it is the VAT rate for the VAT, service or customer that determines which accounts are used. The illustration below is taken from the Account coding tab for a service. It looks the same on the Account coding tab in the customer registry, vehicle registry, etc. To expand to see all VAT rates and accounts, click on ![]() .

.

Your installation expert may have configured settings that change the order below. Carry out a test to ensure that the settings you apply work as intended.

Opter selects accounts and economic units in this order:

1. Price item

- Manual selection from price item row

- Registries designated by the price item (such as material site)

- Settings on the price item

2. Rules in the accounting coding chart

3. Registries in the following order:

- Customer project

- Account coding projects

- Price item

- Extras type

- Expense type

- Vehicle

- Material site

- Customer

- Vehicle type

- Service type

- Driver

- Subcontractor

- Container

- Price list

- Invoice item

- Bill addition type

- Account coding chart

- Region

4. VAT rates

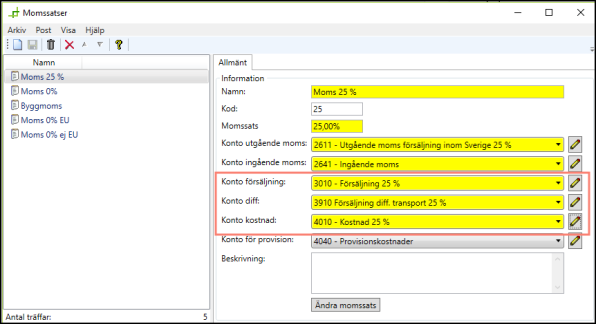

Entering an account for the VAT rate

It is not possible to create VAT rates without specifying sales and cost accounts. This is because these accounts are used as a last resort to ensure that all orders have a sales account and a cost account.

To enter the account for VAT rates, proceed as follows:

1. Click on Economy > VAT rates.

2. Select the VAT rate from the list on the left.

3. Set up accounts for sales, diff and cost on the right.

4. Click on

to save all changes.

Previewing the account coding

In order reception, you can see which accounts and economic units are selected for a particular order and how the rules are used to select them. Proceed as follows:

Open order reception and open an existing order or enter a new one. It is important for the order to have a price so that information can be seen in the preview.

Click on Preview account coding in the Price box.

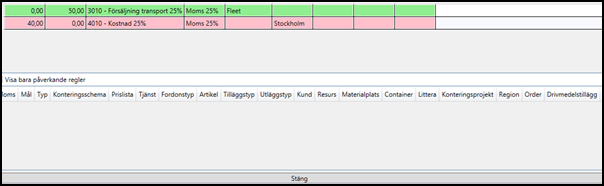

The green rows show the income (to be invoiced) with the account and economic unit(s) for each sub-price. The red rows show costs (to be deducted).

By clicking on a row, you can see the rules in the lower half (rules in the accounting scheme and settings in the registry) that match the order (right service, customer or other conditions). It is also possible to see which row selected the account or the economic unit from the green colour marking.

Note that the preview of the account coding may differ from the way an order is coded in the sales ledger if the account settings have changed since the invoice period was closed.